- 4 min read

Staff Performance Metrics in a Small Accounting Firm

- Share via:

- Copy link

Firms are always looking for innovative ways to make changes to their workplaces. One new example is performance-based pay.

This payment method allows you to pay your employees based on their work performance, as well as the performance of your business.

Whether their performance is giving your firm a positive or negative outlook, you can choose how you pay your employees and what goals they should strive for as they continue to reel in well-done efforts into the workplace.

Let’s take a closer look at what it might look like to implement performance-based pay in your firm.

What is Performance-Based Pay?

Performance-based compensation is an alternative way of paying your employees, opposed to a predetermined salary.

While performance-based pay is typically used in the sales environment to register how well employees are performing, tax and accounting firms are beginning to use this method of payment in their workplace.

Many firms are converting their staff from hourly rates or salary-based pay to commission-based payment systems. Besides sales, employers of all types are focusing more on their staff’s performance to evaluate pay.

Employers constantly assess performance reviews and evaluations in the business world. In firms, employers use performance-based pay to motivate their employees. The payment helps drive performance within the firm and for the individual employee. It also improves compensation for solid accountants and draws the right talent into firms.

Your firm might sometimes lack motivators to keep your employees moving--performance-based pay can help create a buzzing work environment in your firm.

You, as the employer, can use performance-based pay to evaluate your firm’s overall performance and assess the performance of your team members. As your employees meet your goals, you can welcome them to performance-based rewards.

Pros and Cons for Accountants

Pros of using performance-based pay to compensate your employees:

- Sets tangible goals for your employees

- Measures metrics regarding meeting monthly and/or yearly goals

- Helps employers easily recognize their employees’ performances

- If an individual employee’s performance is positive, you can reward them for their work and motivate them to keep performing well. If the employee is harming their overall work and your firm, you can reprimand them.

- Gives staff goals to work toward

- As your employees represent performance you deem great for your firm, you can give them rewards. For example, a bonus, staff trip, conference, or other rewards that would positively impact their work.

Cons of using performance-based pay to compensate your employees:

- Involves more complex and detailed reporting

- Requires training to understand the system

- If you want your employee to work in a specific way to meet their performance goals, then you need to convey this to your staff. Otherwise, you will never get the results you desire.

- Entails change

- If your employees have worked in a system you created for a long time, then it might take them even more time to situate themselves into this new performance-based system. It also might upset or draw employees away.

- Takes time to keep track of the system accurately

- Your key indicators must be appropriate

- You cannot set goals that are going to frustrate a majority of your staff--you want the goals to be achievable.

Performance Metrics for Gauging Team Effectiveness

Every firm has different key metrics for its staff.

For example, a traditional or larger firm may decide that an employee’s billable hours are the key to their metrics instead of a lifestyle-based practice. The firm might find that employees favor the billable hours' option much more for the lifestyle-based practice could potentially tie the happiness and productivity of the firm to people working more hours.

The Journal of Accountancy published “Pay Your Staff for Performance,” which draws its main focuses on a base-pay model, more productivity, and new business bonuses.

While there is no harm in a new business bonus of 10 to 20 percent of first-year revenue, few staff members will fit into the correct personality fit for the sales’ needs of that request.

The downside of this model is the lack of work-life balance which is essential to the individual employees and your own performance in your firm. Converting to value pricing may be imperative for a lifestyle-based practice.

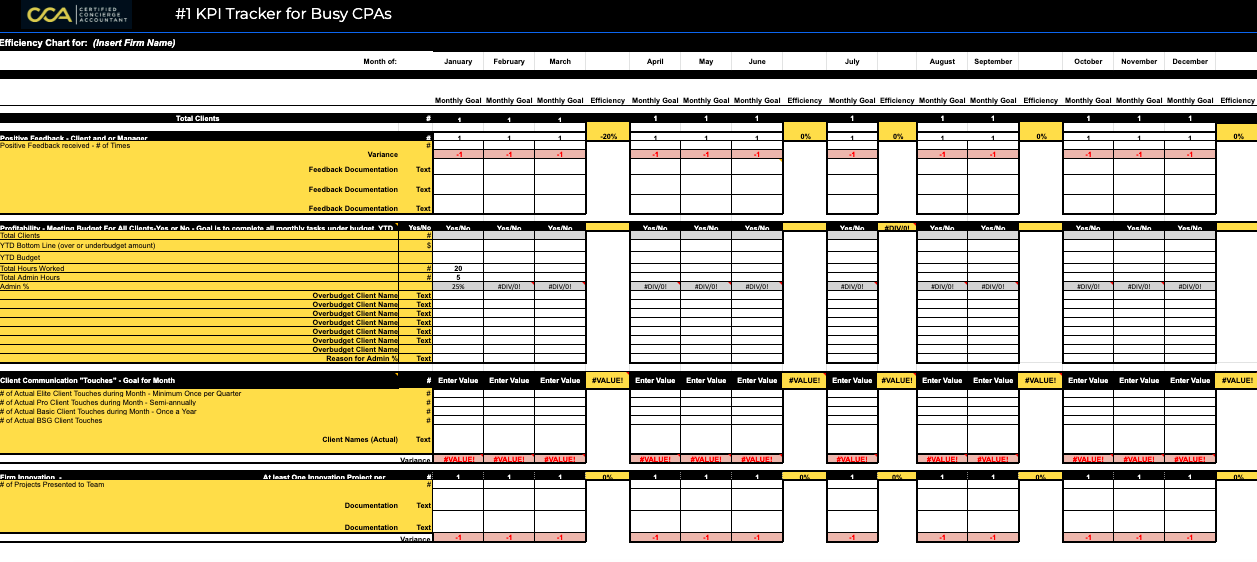

Common metrics or key performance indicators (KPIs) used per staff member include:

- Bookkeeper dollar-per-hour production rate

- Monthly revenue: How much revenue do they bring to your firm?

- Project backlog: Is a staff member holding onto projects and work that they should complete?

- Billable hours or amount-per-billable-hour

- Drops reason: a 12-month rolling average: E.g., closed, fired, price, service, etc.

- Number of clients: The amount of clients that an employee keeps track of/communicates with

- Realization rate: The difference between what you record as time and what percentage of time the client pays

- Meaningful client monthly contact: It’s essential to communicate with your clients. Your clients will remember these conversations with you and expect to have more in the future.

- Client ROI: How much each client saves due to tax strategies

A Place to Track Performance

Performance-based pay is becoming a quick trend in workplaces. While there is pressure from other industries to convert to a more commission-based pay based on metrics, there is no particular or exact method for applying performance-based pay metrics in a tax or accounting firm.

You can combine your own goals that you want for your workplace with other metrics found in other firms. Each firm must evaluate what its culture values the most and pay attention to the unintended consequences of those values. Depending on the software or system you use to track work, it may be simple--or difficult--to calculate KPIs.

If you want to compensate based on your firm’s metrics, then you need to keep detailed track of them. Some firms may also track external metrics like the number of leads or client closes manually in Excel and focus less on internal metrics.

To help with this, we've created a template for tracking all these metrics and KPIs.

In any case, it is important to collect feedback consistently from the staff via one-on-one meetings and from clients in surveys.

TaxPlanIQ has detailed metric tracking and comment client metrics. It also provides you with the most common tax strategies used to help you find ways to save time and money for your clients.

Contact TaxPlanIQ to learn more and use one of their free trials today!

Popular blogs

Interviews, tips, guides, industry best practices, and news.

Picture this… you're out on the golf course, having a blast, when suddenly you stumble upo...

Business owners and entrepreneurs are always looking for legitimate and easy ways to save ...

Cryptocurrency and digital assets are rapidly evolving, and tax regulations are finally ca...

When you sell an investment property, the capital gains tax can put a big dent in your pro...

Investing in stocks that pay out dividends is a popular strategy for generating passive in...