Create Tax Plans Fast with Affordable Tax Planning Software

Our tax planning software is the fastest, most affordable way for growing firms to build expert-level tax plans for clients… even if you’ve never done tax planning before.

✅ The TaxPlanIQ Growth Plan is Backed by a 100% Money Back Guarantee

$5B

in Tax Savings identified

1,200+

Firms Use TaxPlanIQ

The Only Tax Planning Software Backed by a 100% Money-Back Guarantee*

Not only is TaxPlanIQ the most affordable tax planning software for accounting firms, but it’s the only one with a 100% money-back guarantee*. With the TaxPlanIQ Growth Plan, we assume the risk so you don’t have to. If you don’t see results during your 12-month agreement, you’ll get a full refund.*

Get a Demo*Terms And Conditions Apply.

Real Firms. Real Wins.

Case Study

Why One CPA Replaced His Costly Tax Planning Software with TaxPlanIQ—and Never Looked Back

I used to think I couldn’t help high-earning W-2 clients (with his old tax planning software) but TaxPlanIQ opened that door. Now, I’ve got plans for ultra-high earners—$500K, $600K income folks—who are thrilled when I show them real savings.

John Sanchez, CPA

Read More & Watch Video

Case Study

How This CPA Went From From Free Advice to 6 Figures in Additional Revenue

TaxPlanIQ lets us show clients the difference between where they are now and where they could be. The ROI reports make it incredibly clear—and that clarity makes it easy for clients to say yes.

Merrill Taylor, CPA

Read More & Watch Video

Case Study

How One EA Achieved 95% YoY Firm Revenue Growth

“There’s the McDonald’s model, and there’s the Michelin model. I’d rather work with fewer clients and deliver truly premium value. That’s the type of practice I want to run, and TaxPlanIQ helps make it possible.”

Daniel Guarin, EA

Read More & Watch Video

1,200+ firms are using TaxPlanIQ to grow profitably—with less stress and better clients.

See All Case StudiesFeatures of TaxPlanIQ Tax Planning Software

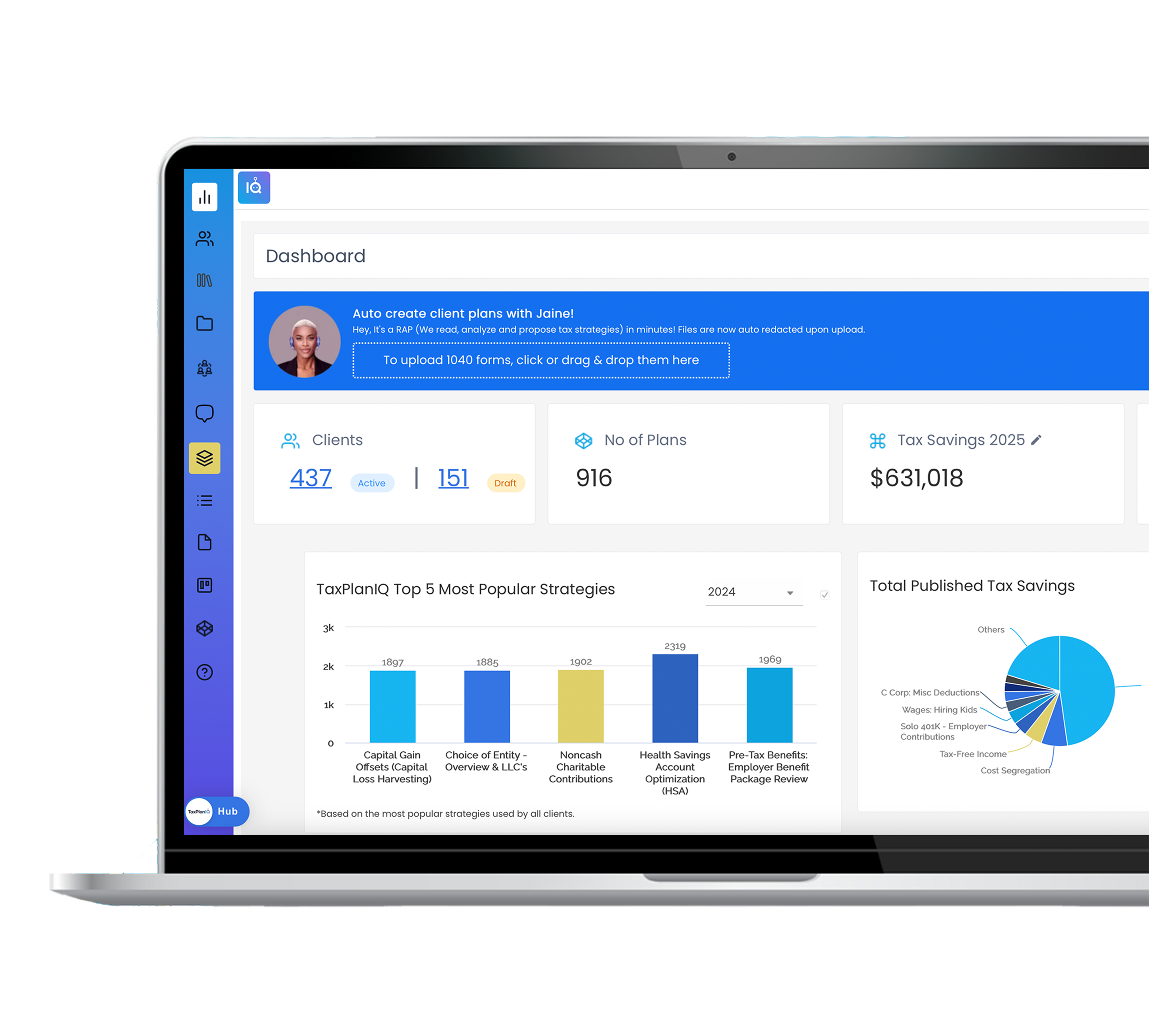

Instantly Analyze Your Clients for Opportunities

Upload up to one hundred 1040s at once. AI then identifies potential savings and prioritizes high-opportunity clients making client selection a breeze.

Get Answers Fast with Our AI Tax Planning Software Assistant

Get real-time answers to complex tax planning questions and step-by-step guidance as you create tax plans with jAIne, our AI tax planning assistant.

.png)

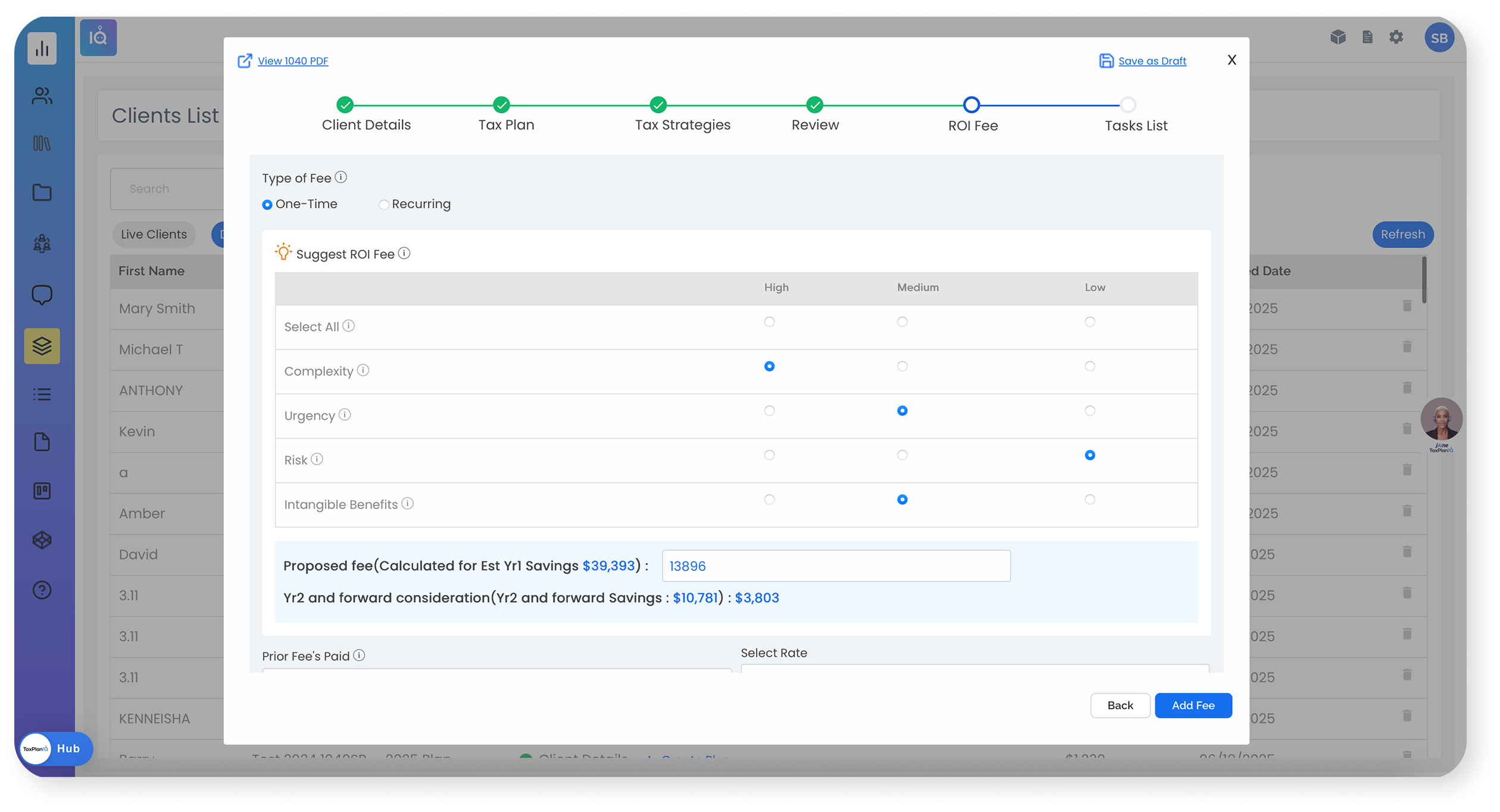

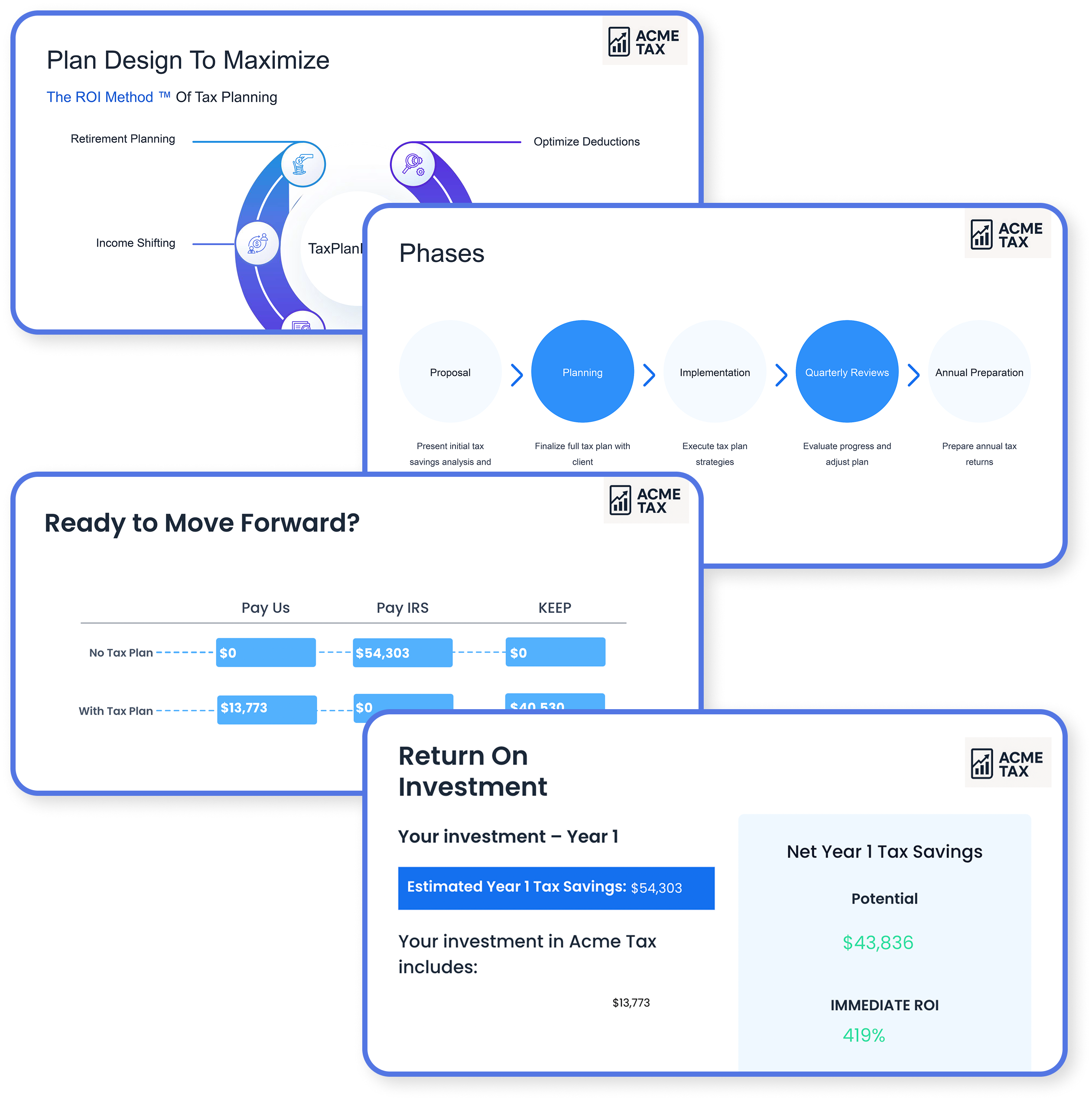

Price & Plan with Confidence

Take the guesswork out of tax planning pricing. Get easy ROI Method pricing structure and detailed ROI reports to show clients measurable value of their tax plan.

Your clients view you as an expense. TaxPlanIQ tax planning software helps you be seen as an asset.

Whether you’re burned out, undervalued, or tired of clients price-shopping your worth, we’ll show you how to become their most trusted advisor and add significant revenue and profit to your firm's bottom line.

Tax planning is at the forefront of the Advisory shift, and is the easiest advisory service to add to your firm.

Tax planning is the easiest advisory service to add because it leverages the work you’re already doing—no new degree, certification, or staffing required. With TaxPlanIQ, you can turn a client’s 1040 into a customized, high-value tax plan in minutes.

That means you’re not just filing returns—you’re uncovering savings, creating new revenue streams, and building deeper client relationships that lead to more profitable engagements, year after year.

Here’s How to Become the #1 Asset In Your Client’s Life

TaxPlanIQ is easily the most affordable tax planning software on the market. It's also your bridge to a better business model where you can build tax plans in just minutes.

Step 1

Upload multiple 1040 PDFs (or just one if you know who you want to plan for).

AI extracts data and begins finding savings immediately.

.png)

Step 2

Verify the auto-filled info.

Make sure income, rates, and filing data are accurate.

.png)

Step 3

Apply tax-saving strategies.

Our AI recommends proven, up-to-date strategies tailored to the return.

.png)

Step 4

Set ROI-based pricing.

Use complexity and urgency to determine exactly what to charge.

Step 5

Deliver the full proposal.

A professional, client-ready tax plan is ready in minutes.

See Our Pricing Plans

Get started for as little as $397/ month

100% Money-Back Guarantee when you choose the Growth Plan*

Tax Planning Software Built for Accounting Firms of All Sizes

See Plans & Pricing- Small Firms – Save time, add value, and raise your rates

- Large Firms – Systematize tax planning, eliminate spreadsheets, and scale a consistent process across teams and locations

- Growing Firms – Systematize tax planning and scale advisory work

- Bookkeepers – Upgrade to strategic revenue streams

- Accountants in Transition – Make advisory your core service offering

.png?width=357&height=85&name=tpiq-logo%20(375x85).png)