Efficiency . Value . Success. Meet TaxPlanIQ. Your tax advisory operations platform.

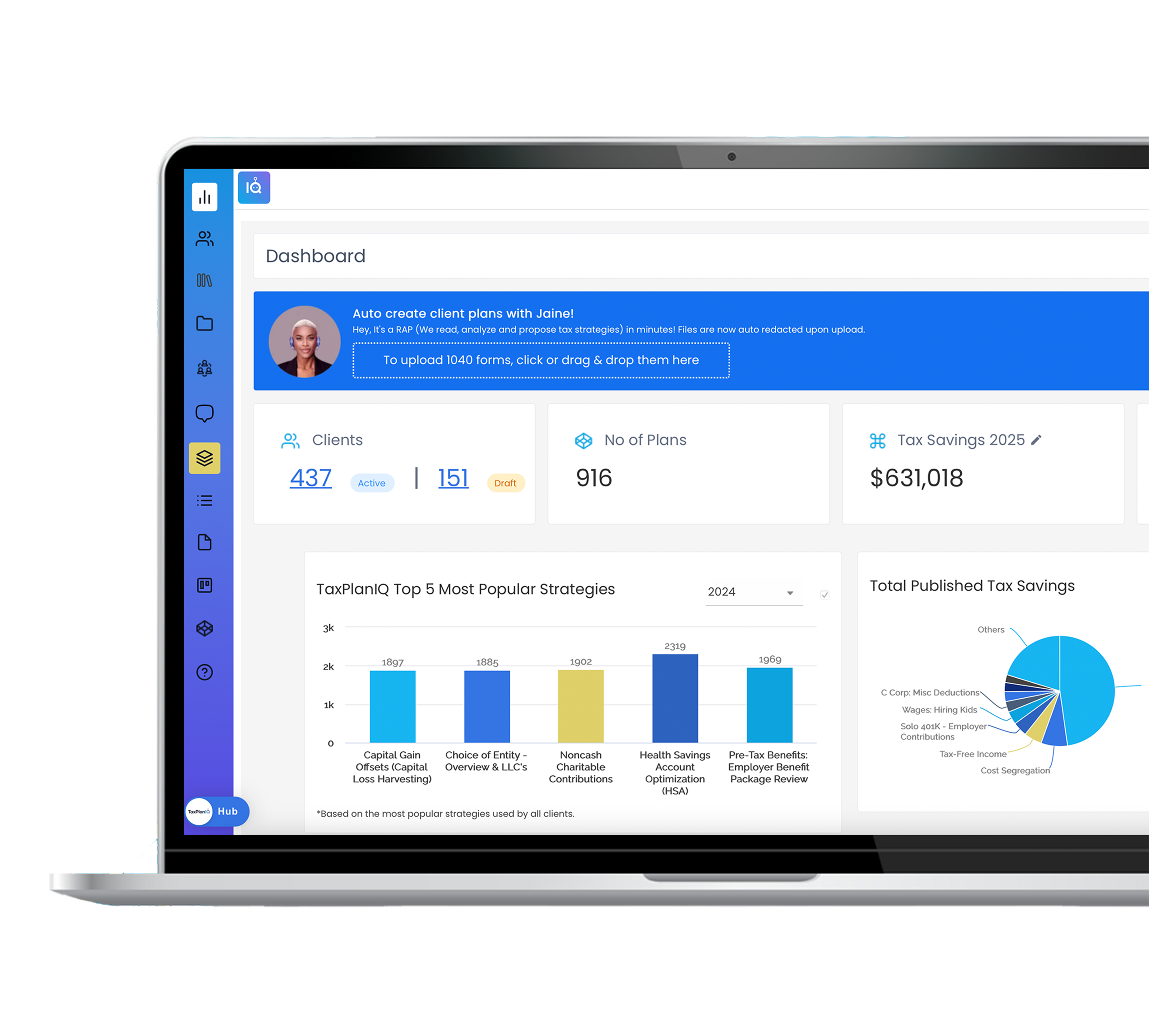

The intelligent way to create tax plans, manage engagements, facilitate live collaboration, and visualize ROI — all on one platform.

$250M in tax savings | averaging $16,532 per client

Find What Other Advisors Miss

Our tax planning software for financial advisors helps you uncover hidden tax savings for clients—and become the advisor they never want to leave.

✅ The TaxPlanIQ Growth Plan is Backed by a 100% Money Back Guarantee

$5B

in Tax Savings identified

1,200+

Firms Use TaxPlanIQ

The Secret Weapon for Building a New Revenue Stream on Top of Investments & Insurance

TaxPlanIQ unlocks hidden tax savings opportunities inside your existing client base—helping you deliver real value without becoming a tax expert. Let the software handle the heavy lifting for you, then collaborate with your clients’ CPA to turn strategies into results. This is how top advisors stand out, add massive value, and build an entirely new business line—without burning out.

Real Advisors. Real Results.

Case Study

How One Advisor Proved You Don’t Need to Be a CPA to Deliver $100K+ Tax Savings

I’m not a CPA, but TaxPlanIQ gives me the tools to quarterback strategic tax plans with confidence. My first plan saved a client nearly $100,000—and opened the door to multiple new opportunities.

Ron Joseph, Advisor

Read More & Watch Video

Case Study

From Spreadsheets to Strategy: How One Virtual Family Office Uses TaxPlanIQ to Elevate Client Value

It’s not just a presentation—it’s an educational tool. It’s been just as valuable for me as it has been for our clients. It gave me the aha moment of how to present tax planning value in a way that lands.

.jpeg)

Sterling Hirsch, Advisor

Read More & Watch Video

Case Study

Why One CPA Replaced His Costly Tax Planning Software with TaxPlanIQ—and Never Looked Back

I used to think I couldn’t help high-earning W-2 clients (with his old tax planning software) but TaxPlanIQ opened that door. Now, I’ve got plans for ultra-high earners—$500K, $600K income folks—who are thrilled when I show them real savings.

John Sanchez, CPA

Read More & Watch Video

1,200+ firms are using TaxPlanIQ to grow profitably—with less stress and better clients.

See All Case StudiesTax Planning Software for Financial Advisors

Instantly Analyze Your Client Base for Tax Savings Opportunities

Bulk upload client 1040s to quickly identify which clients have the highest tax-saving potential, which easily sets you apart from all other advisors in your area.

Be Proactive in a Way That Truly Moves the Needle

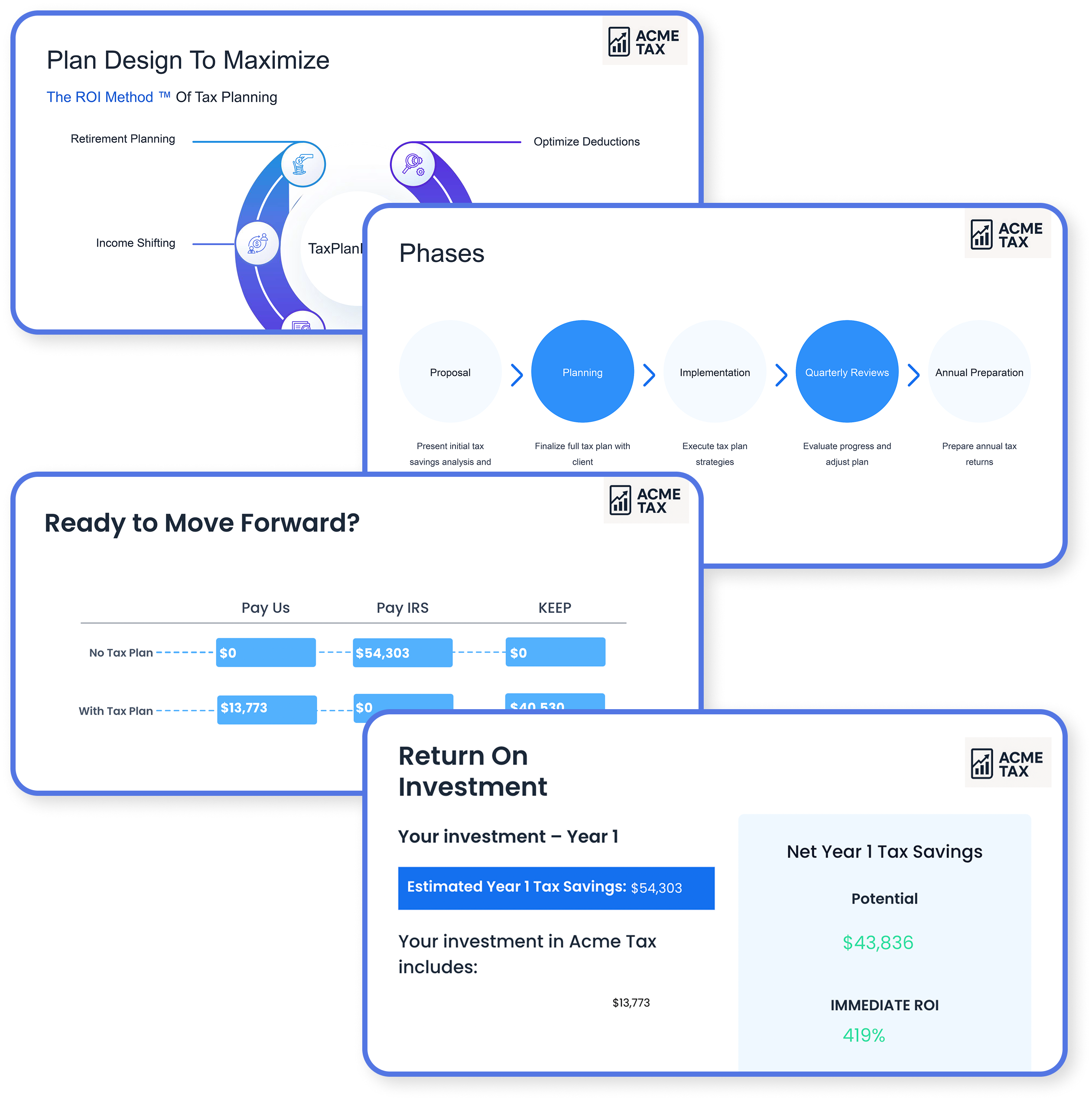

TaxPlanIQ’s ROI-driven tax plans don’t just justify your fees—they unlock new conversations, investment opportunities, and CPA collaboration.

Deepen Client Relationships During Every Interaction

Turn routine reviews into value-added conversations by instantly spotting tax-saving opportunities that show you're thinking proactively about their financial future.

Stop Being Seen As "Just the Investment Person"

TaxPlanIQ helps financial advisors deliver deeper value—and finally become the client’s most trusted financial strategist.

Why Advisors Are Leading With Tax Planning in 2025

See Plans & Pricing- AUM fees alone aren't enough anymore – Clients are questioning what they're paying for—especially when investment platforms charge so little.

- Affluent clients want holistic guidance – Today’s high-income earners expect advisors to coordinate investments, tax strategy, and financial planning—not just manage portfolios.

- Tax planning increases retention – When clients see you helping them save tens of thousands in taxes, they stay. You’re no longer just their "investment person"—you’re their most trusted financial ally.

See How You Can Find Tax Savings For Your Clients in Just Minutes

TaxPlanIQ is easily the most affordable tax planning software on the market. It's also your bridge to a better business model where you can build tax plans and find savings in just minutes.

Step 1

Upload multiple 1040 PDFs (or just one if you know who you want to plan for).

AI extracts data and begins finding savings immediately.

.png)

Step 2

Verify the auto-filled info.

Make sure income, rates, and filing data are accurate.

.png)

Step 3

Apply tax-saving strategies.

Our AI recommends proven, up-to-date strategies tailored to the return.

.png)

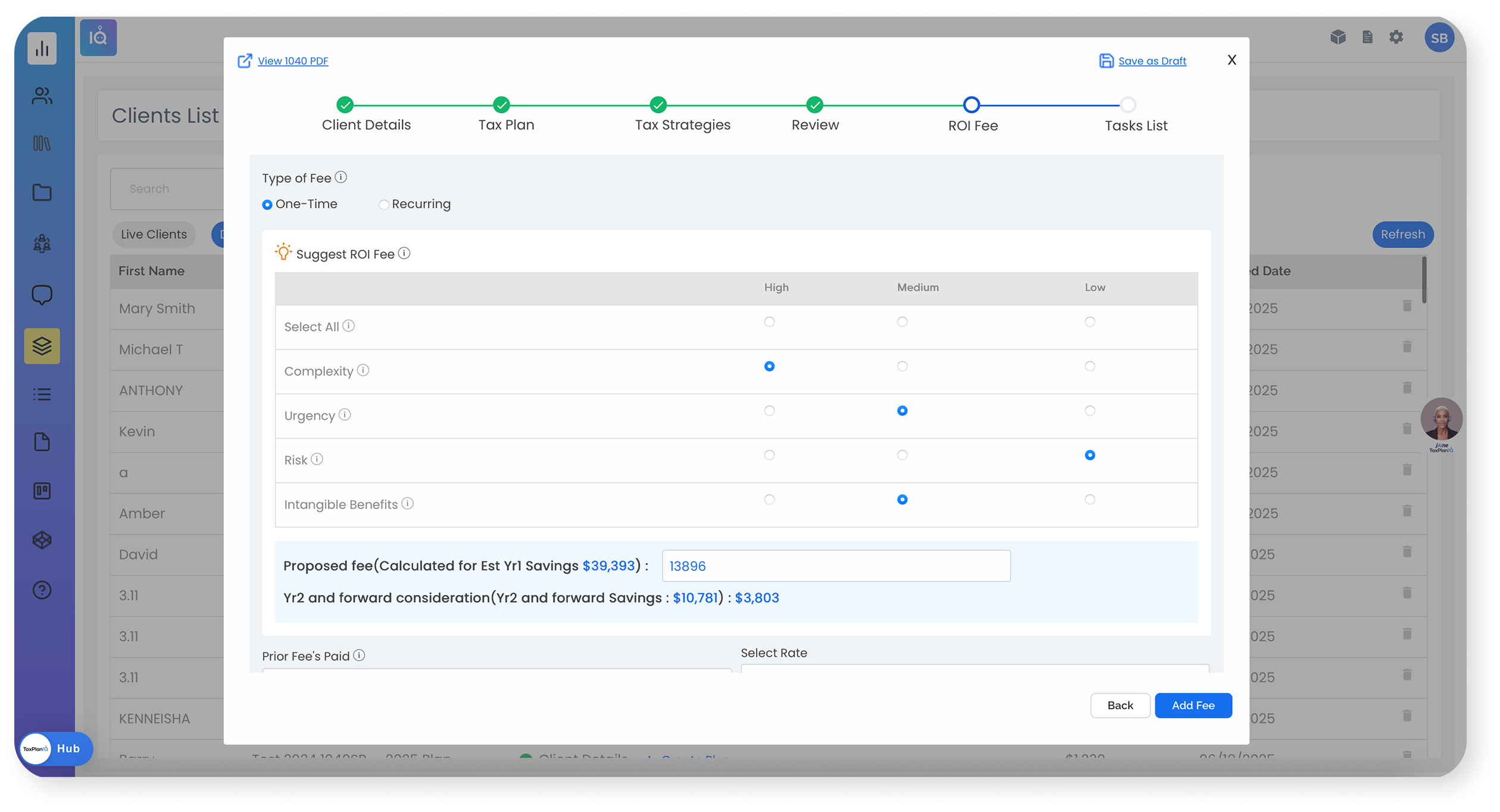

Step 4

Set ROI-based pricing.

Use complexity and urgency to determine exactly what to charge.

Step 5

Deliver the full proposal.

A professional, client-ready tax plan is ready in minutes.

See Our Pricing Plans

Get started for as little as $397/ month

Tax Planning Software Designed for Financial Professionals

See Plans & Pricing- RIAs & Independent Advisors – Offer tax planning without becoming a CPA

- Wealth Managers – Differentiate your value beyond traditional investment products

- Insurance & Retirement Advisors – Complement your core services with tax strategies

- Advisors in Transition – Stand out with holistic, tax-smart financial guidance

You Don’t Need to Be a Tax Pro to Deliver Massive Tax Savings

Tax planning isn’t about doing taxes. It’s about delivering clarity, confidence, and value to your clients. We’ll show you how to add it to your practice—fast.

Get a Demo.png?width=357&height=85&name=tpiq-logo%20(375x85).png)