Case Study

How One Advisor Proves You Don’t Have to Be a CPA to Deliver Strategic Tax Plans

Ron Joseph, founder of Elite Consulting Services, has spent over two decades helping clients find financial freedom—first through mortgage strategies, then through insurance and wealth-building solutions. But his real pivot came when he decided to stop working around CPAs and start working with them.

“I used to call them ‘the mob’—CPAs, brokers—people who could ruin everything if they weren’t aligned,” Ron explained. “So I figured, why not partner with them instead?”

That shift led Ron to Elite Resource Team’s (ERT) model, which emphasizes collaboration between advisors and CPAs. Through that ecosystem, he discovered TaxPlanIQ—a tax planning platform that immediately stood out.

“I’m always thinking blue ocean strategy,” Ron said. “If I want to be different, I need different tools. TaxPlanIQ helps me bring something to the table that most CPAs don’t even know exists.”

Before TaxPlanIQ: Reactive Processes and Missed Opportunities

Like many CPAs, Ron’s was stuck in a tax prep mindset. “He was hustling on the treadmill of tax prep,” Ron said. “I asked him, what if we could do something different? What if we focused on your A-clients and added real value instead of just filing returns?”

Ron recognized a major gap in the market: CPAs wanted to be more proactive but didn’t have the time, tools, or support to do it. That’s where TaxPlanIQ came in.

“It’s not that CPAs don’t care. It’s that they don’t have the resources,” he explained. “They’re not shifting to advisory because they don’t know how.”

You Don’t Have to Be a CPA to Deliver Strategic Tax Plans—or Unlock Downstream Revenue

Ron Joseph isn’t a CPA. He’s an advisor and facilitator. But thanks to TaxPlanIQ, that hasn’t stopped him from delivering serious tax savings to clients—and opening the door to significantly more revenue across his business.

“I’m not a CPA, and I’m learning as I go,” he said. “But I know enough to be dangerous. And I’ve got a team behind me to make sure it’s done right.”

With TaxPlanIQ, Ron doesn’t offer tax advice. He gathers client data, runs the scenario through the software, and then brings the CPA and TaxPlanIQ’s expert team into the conversation.

“I’m like the quarterback,” Ron explained. “The client comes in through the CPA, and then I show the CPA, ‘Here’s what’s possible.’ We talk it through, and if needed, I bring in Veronica from the TaxPlanIQ team. We collaborate.”

That approach helped Ron close his first tax planning engagement for over $30,000 in planning fees. The client? A family-owned car wash business.

“She sat through the plan presentation, changed the subject, and I started packing up,” Ron recalled. “Then she said, ‘I’m ready. Who do I write the check to?’ I was jumping up and down inside.”

The plan is expected to save her close to $100,000 in taxes—and it’s already led to conversations with other family members and clients.

“That was just the plan,” Ron added. “It didn’t include the life insurance, cash balance plan, or any of the other follow-on opportunities we’ll implement. That’s all on top.”

By leading with tax planning, Ron found that clients become far more open to discussing wealth-building and protection strategies.

“When you show people how to keep the money they’re already making, they’re way more open to talking about how to grow or protect it,” he said.

It also validated Ron’s decision to invest in the software himself—without waiting for his CPA partner to buy in.

“I knew they wouldn’t do it,” Ron said. “Most CPAs aren’t thinking like that yet. But I want to be different. If you want to be in the blue ocean, you need different tools—and this is one of them.”

For advisors and insurance professionals looking to expand into tax planning, Ron’s approach is proof of concept: you don’t have to be a tax expert to lead with value—just someone willing to coordinate, collaborate, and ask better questions. One tax plan often turns into multiple revenue streams.

“My CPA started saying, ‘Hey, I’ve got another client we should talk to.’ That’s when I knew we were onto something.”

What Makes TaxPlanIQ Different: Tools, Training, and Confidence

For Ron, TaxPlanIQ’s value isn’t just in the software—it’s in the structure.

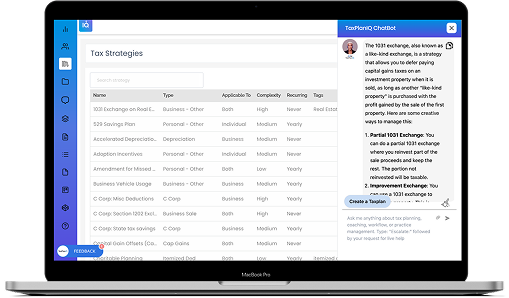

“The tax code is too big. You can’t know it all,” he said. “But TaxPlanIQ curates the best strategies, gives you court case references, pros and cons, pricing guidance—it’s all there built into the software. I just click a few buttons and it spits out a fair price for the plan for me.”

The Growth Plan’s video training and strategy support turned Ron from a tax planning novice into a confident consultant.

“I’ve studied Sandler Selling. I know how to present without selling. And with TaxPlanIQ, I’ve got a platform that backs up everything I’m saying,” he said.

The included ROI Method pricing structure—based on models endorsed by the AICPA—help advisors confidently price their services without guesswork.

How Tax Planning is a Win-Win-Win model

TaxPlanIQ didn’t just help Ron build a new revenue stream. It made him a more valuable partner to his CPA and a more trusted resource to clients.

“I’m not trying to be the hero. I’m trying to help the CPA become a next-level CPA,” Ron said. “I help them find money their clients are giving away unknowingly and unnecessarily.”

And he’s not shy about why he took the leap before his CPA did.

“You’ve got to believe you’re different. CPAs are still in the red ocean. I’m in the blue ocean, helping people work smarter—not harder.”

High-Value Planning, Just Minutes Away

TaxPlanIQ empowers advisors and accountants to create branded, personalized tax plans in just minutes—without needing to be tax experts. With curated strategies, clear implementation steps, and on-demand support, professionals like Ron can deliver six-figure tax savings and real results.

Want to see how TaxPlanIQ can help you grow your firm and deliver more value to clients?

Sign up for a complimentary demo today.

Book a Demo