Case Study

Why One CPA Replaced His Costly Tax Planning Software with TaxPlanIQ—and Never Looked Back

From Compliance-Heavy to Advisory-Focused

When John Sanchez founded John A. Sanchez & Company in Auburn Hills, Michigan, the firm operated like many small tax practices—focused heavily on compliance. But around 2018, John began a slow, deliberate shift toward advisory services.

“I started to find my voice,” John recalled. “I thought, what could I find that someone else hasn’t already? But I was shocked. Even basic strategies weren’t being used by other CPAs.”

That realization sparked a transformation. Today, 90% of the firm’s advisory work revolves around tax planning and strategy—a shift that’s unlocked high-value engagements and remarkable outcomes for clients.

“It’s a high-value delivery. Not only are we winning from a fee standpoint, but we’re making a difference in the client’s life,” said John. “We’re preserving wealth for their families. That’s what it comes down to.”

The Search for the Right Tax Planning Software

Like many accountants looking to scale advisory services, John initially adopted a different, more expensive tax planning software. While it worked at first, the experience quickly soured.

“It went from easy to cumbersome,” John explained. “I was spending more time trying to figure out the software than actually building plans. I didn’t trust the numbers.”

Eventually, frustration with usability and cost pushed John to re-evaluate his tools. He decided to give TaxPlanIQ another look.

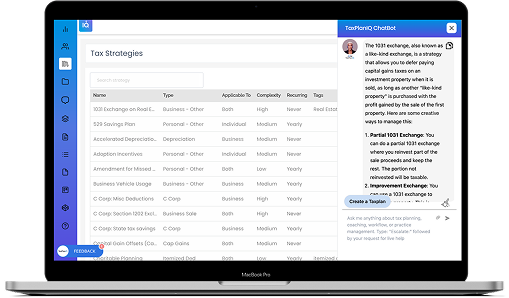

“Right away, it just worked with my brain better,” John said. “It’s more intuitive. I can have a plan up and running in 15 minutes—and something client-ready in under an hour.”

Switching to TaxPlanIQ wasn’t just a time-saver; it slashed software costs by nearly 50%. “It was a no-brainer,” he said. “Better product, lower cost.”

“I didn’t feel I was getting near what I feel I should have for the investment [with the old expensive software]. So it was that double frustration…seeing how much easier it was to use and that cost difference—boom, this is a no-brainer.”

Delivering Big Wins for Clients—and the Firm

Since implementing TaxPlanIQ’s tax planning software, John’s firm has achieved results most accountants dream about:

10M

Eliminating a $10 million tax bill for a client selling their business

250K

Saving another client $250,000 through targeted strategies

2X

Doubling advisory revenue year-over-year, with no increase in staffing

And that’s just the start.

“I used to think I couldn’t help high-earning W-2 clients [with the old software that was focused on business return clients only]. But TaxPlanIQ opened that door,” John explained. “Now, I’ve got plans for ultra-high earners—$500K, $600K income folks—who are thrilled when I show them real savings.”

“Definitely this year will be a banner year for us. But it’s funny because I’ve said that last year and the year before. So it’s like every year is a banner year.”

These advisory wins haven’t just benefited clients—they’ve changed John’s own life. “My last three tax seasons? Practically no overtime. That’s not just good for me—it’s good for my family, my team, and our clients.”

Why TaxPlanIQ Works

According to John, the software's power lies in its ease of use, curated strategies, and preferred partner ecosystem.

“I probably haven’t even tapped into everything it can do yet,” he admitted. “But the parts I do use work incredibly well. And the built-in partner referrals? Game-changing for complex strategies. You've got a whole team behind you that's invested in your success.”

For accountants new to advisory work, John offers clear advice: Don’t wait for perfection.

“You’ve got to find your voice—and having the right tool matters. You might fall flat at first, but that first win will change everything.”

The Bottom Line: High-Value Tax Planning in Minutes

TaxPlanIQ helps tax professionals create high-value, client-branded tax plans in minutes. With curated strategies, real savings calculations, and implementation guides, it enables firms like John’s to deliver scalable advisory services—and real ROI.

“I don’t know why you wouldn’t do this... staying in the tax preparation mindset only, that’s got a limited shelf life—if it’s not already expired.”

Ready to see what it can do for your firm?

Book a complimentary demo of TaxPlanIQ and start building higher-value tax plans—fast.

Book a Demo.png?width=357&height=85&name=tpiq-logo%20(375x85).png)