Case Study

How One CPA Delivers High-Value Tax Plans as a New Firm Owner

Sargis Ivanov is the founder of Sargis Ivanov, CPA, PLLC. After a couple of years in tax preparation and earning his CPA in 2025, he launched his own firm in February—right in the middle of tax season. Like many new firm owners, he started with individual returns and small bookkeeping projects while figuring out what he wanted his firm to become.

What changed quickly was how he viewed his role and value as an advisor. “TaxPlanIQ has massively shifted the way that I think about what I want my firm to be,” Sargis said. “Being able to communicate my value to people… allows me to make more money, invest in better technology, and invest in people.”

That shift translated into growth faster than he expected.

“I’ve actually hired two people, which is mind-boggling. I thought I was going to be a solo show for the next couple years.”

Before TaxPlanIQ: Informal Advice with No Structure or Scale

Before using TaxPlanIQ, Sargis believed he was doing advisory work—but in hindsight, it was unstructured and underpriced. He would casually suggest ideas like retirement contributions, home office deductions, or S-Corp elections, often during tax prep conversations.

“I was just kind of giving it away for free and not helping with the implementation either,” he explained. “So I didn’t really deserve to be getting paid the big bucks.”

Without a formal process, he wasn’t packaging tax planning as a service, and clients weren’t experiencing the full value of proactive strategy paired with execution. Like many accountants, he had knowledge but lacked a repeatable system to turn that knowledge into a premium, scalable offering.

Choosing TaxPlanIQ: Support, Confidence, and a Needed Push

Sargis learned about tax planning software through a colleague who encouraged him to explore new ways to add value. After meeting with two providers, the contrast was clear. One dismissed him as too early-stage. TaxPlanIQ took a very different approach.

During his demo, Sargis appreciated the direct and supportive conversation. “Chris kept pushing me,” he said. “He was like, you need to make this jump if you want to see a different result. I needed someone to tell me I could do this.”

That encouragement aligned with advice he was hearing elsewhere—and helped him commit. “On the other side of a commitment that big, I can literally cover my cost in one or two fees,” he noted. Even beyond revenue, the mindset shift stood out. “Even if I hadn’t made a penny, that mindset shift itself was worth it.”

A Standout Win: $70,000 in Client Tax Savings

One of Sargis’s biggest early successes came from a new client who found him through Google and asked for help reviewing a rental property situation.

$70k

Tax savings delivered through proactive planning

15+

Years of value recovered through planning

Win

A routine review turned into a major success

The client had owned two rental properties—one for 15 years and another for 10—and had never taken depreciation. “I realized he’d never taken depreciation on a single one of them,” Sargis said. “I was like, this is huge.”

With support from the TaxPlanIQ team, he built and executed a plan that used catch-up depreciation. The outcome was significant. “We’re going to end up saving him $70,000,” he shared.

Client Reactions: From Bad News to Meaningful Results

Sargis noticed a clear difference between his earlier client base and the new clients he began attracting once he could confidently offer tax planning. While some legacy lower income 1040-only clients weren’t a fit, new clients responded strongly.

“All the new clients I’ve brought in have loved it. They’re like, I love that we’re saving money. You’re awesome with communicating. I’m going to introduce you to people who need your help.”

After selling three tax plans, the pattern became clear. “The reaction has been amazing,” Sargis explained. “They’ve never met an accountant that tells them good news instead of bad news.”

He now closes conversations with a line that resonates. “I’m the most expensive accountant you’re ever going to have, but I’m going to save you the most money,” he said. “They love that line because it’s ended up being true.”

One-on-One Guidance That Feels Like a Team

Beyond the software itself, Sargis credits the Growth Plan support for helping him move faster and with more confidence. Working closely with Bobby and Veronica gave him both technical guidance and perspective.

“Bobby’s really been holding my hand,” he shared. “There’s no stupid question. Let’s walk through this together.”

A lesson from Veronica also changed how he values his time. “You shouldn’t be doing this much work if no one’s paying you yet,” Sargis recalled. “That little nugget meant the world to me.”

Together, that support removed the isolation many solo firm owners feel.

"With the growth plan, I feel like I have a whole big team around me. I feel like a big accounting firm.”

Advice for Other Accountants

For accountants considering tax planning, Sargis is clear that this isn’t hype—it’s adaptation. “AI is entering everything,” he said. “To differentiate yourself, you have to move upstream.”

He encourages accountants to focus on business owners, high-income earners, and real estate investors—clients whose situations require judgment, strategy, and guidance. His bottom-line advice is simple: “If you keep doing the same thing and expecting a different result, that’s the definition of insanity. You’ve got to do something different.”

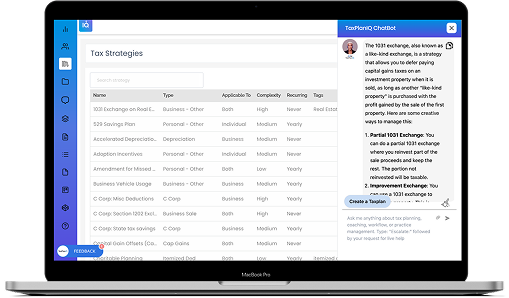

Creating High-Value Tax Plans with TaxPlanIQ

Sargis’s experience shows what’s possible when tax planning becomes structured and actionable. TaxPlanIQ allows advisors to upload a client’s 1040, uncover curated tax strategies, and quickly create custom-branded tax plans that highlight potential savings. Each plan includes implementation steps, pros and cons, and supporting references—making tax planning a high-value, scalable service for modern firms..

Want to see how TaxPlanIQ can help you create high-value tax plans in minutes?

Schedule a complimentary demo today.

Book a Demo.png?width=357&height=85&name=tpiq-logo%20(375x85).png)