Case Study

From Spreadsheets to Strategy: How One Virtual Family Office Uses TaxPlanIQ to Elevate Client Value

When Sterling Hirsch founded Collective VFO, he wasn’t setting out to build just another wealth management firm. He envisioned something more integrated—what he calls a Virtual Family Office (VFO). This model brings together a client’s full advisory team—CPAs, attorneys, and financial professionals—under one strategic umbrella. “We operate as consultants, not product-pushers,” Hirsch explained. “Collective VFO doesn’t sell securities. We start with client priorities—often tax reduction—and build from there.”

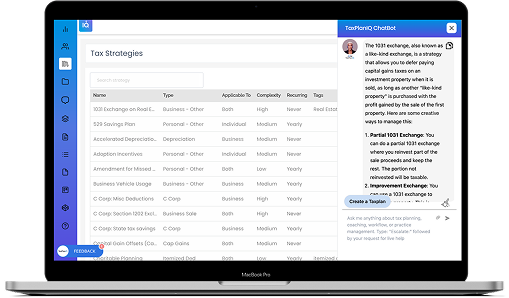

That’s where TaxPlanIQ, a purpose-built tax planning software for financial advisors, comes into play.

Before: Disjointed Spreadsheets and Missed Opportunities

Before adopting TaxPlanIQ, tax planning at Collective VFO was functional but fragmented. “We were using spreadsheets in collaboration with our CPA partners,” Hirsch shared. “There was value there, but it wasn’t cohesive. It wasn’t as efficient as it could be.”

Despite Sterling’s strong financial background, he knew he needed a more streamlined, client-facing way to build and communicate tax strategies.

“I don’t do taxes—I’m not a CPA. But I work closely with them. We needed a unified planning process that everyone could work from.”

After: Efficiency, Clarity, and Strategic ROI

Sterling discovered TaxPlanIQ through a webinar hosted by Elite Resource Team. What sold him was its ROI-based planning methodology. “The ROI method was a huge catalyst,” he said. “It helped us determine the value of the planning we’re doing on behalf of the client. That alone has changed the game.”

More than just numbers on a screen, TaxPlanIQ helps Sterling educate his clients while establishing concrete value. “It’s not just a presentation—it’s an educational tool,” he explained. “It’s been just as valuable for me as it has been for our clients. It gave me the aha moment of how to present tax planning value in a way that lands.”

Sterling and his team use both the ROI report and the sales presentation features inside the platform. “It lets us walk the client through complexity—market risk, audit risk, implementation timelines—all in a visual, digestible way. And when they see their tax savings? The reaction is almost always, ‘Why wouldn’t we?’”

A Model That Scales With Trust

TaxPlanIQ isn’t about working in a vacuum.

60%

Tax planning and VFO services now make up 60% of total revenue.

Unified

Unifying CPAs and advisors through tax planning

Team

Hiring a full-time team member dedicated to tax planning implementation

Advice for Advisors: Don’t Go It Alone

To other financial advisors wondering whether they can break into tax planning, Sterling doesn’t mince words: “You have to learn how to build strategic partnerships. And you have to get over the fear of the unknown.”

He credits groups like Elite Resource Team and tools like TaxPlanIQ for giving him the framework and confidence to build a new business model. “Most financial advisors won’t survive unless they bring personalized, high-value advice to the table. Traditional planning is being automated. You’ve got to evolve.”

His advice: Start now.

“TaxPlanIQ isn’t just software—it’s a gateway to delivering a more meaningful client experience. If you can bring real value, you’re going to stay relevant.”

Deliver Tax Savings.

Scale Your Firm.

Sterling’s experience shows that tax planning is no longer a “nice-to-have”—it’s an essential part of delivering advisory services that actually move the needle for clients. And with TaxPlanIQ’s tax planning software for financial advisors, those plans don’t have to take hours.

With just a client’s 1040, TaxPlanIQ surfaces relevant tax strategies, provides implementation steps, and generates a white-labeled tax plan in minutes. That plan isn’t just a report—it’s a powerful conversation starter.

Want to see how TaxPlanIQ can help you create high-value tax plans in minutes?

Schedule a complimentary demo today.

Book a Demo.png?width=357&height=85&name=tpiq-logo%20(375x85).png)