Case Study

How This CPA Went From From Free Advice to 6 Figures in Additional Revenue with Tax Planning Software for CPAs

A CPA Firm Ready for Evolution

Merrill Taylor, CPA, has been in the tax world for over 20 years. After a decade at Ernst & Young and a large Utah-based firm, he launched his own practice—Taylor Tax Team—focusing primarily on tax compliance with a bit of bookkeeping on the side. Today, Merrill leads a seven-person team with a growing emphasis on tax planning and consulting.

"We always did a bit of tax planning," Merrill said, "but we gave it away for free because we didn't fully understand the value."

“I used to think, ‘Why would you charge that much? It’s really simple,’” Merrill recalled. “But then I saw peers doing it differently—charging real fees and actually guiding clients through the implementation. That opened my eyes.”

The Problem: Free Advice, Limited Value

Before using TaxPlanIQ, Merrill’s tax planning efforts were basic and informal. "We'd do projections or toss out a strategy or two, but it wasn’t systematic," he explained. "Because it was free, we weren’t invested in doing it deeply."

The firm relied on software like Lacerte for tax projections, but it didn’t offer a clear, visual way to communicate value to clients. “We could show different scenarios,” he said, “but it didn’t package things in a client-friendly way.”

That changed after Merrill joined a mastermind group at ERT and was reintroduced to TaxPlanIQ. As his firm explored more advanced tax strategies, he realized a better presentation tool was critical to charging premium fees and closing advisory engagements.

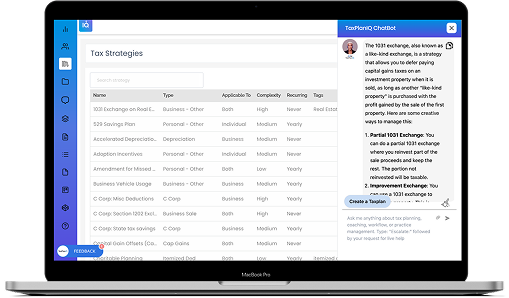

The Solution: TaxPlanIQ as a Revenue Driver

TaxPlanIQ provided exactly what Merrill needed: a powerful, visual way to show clients their current situation, recommended strategies, and projected tax savings. “It’s that ROI story,” Merrill said. “Clients want to know: if I pay you this, what am I getting in return? TaxPlanIQ makes that an easy conversation.

Merrill uses both the ROI and presentation reports in client meetings. The results? “I can’t think of anyone who has said no after seeing the report. Our close rate is basically 100%.”

In just the final months of the year after adopting the software, Merrill’s firm brought in over $170,000 in new revenue. “We weren’t expecting that much. It lit a fire under us to start much earlier this year,” he said.

And with one client saving $1.6 million in taxes, referrals are now pouring in. “That client’s sent more business our way, and everyone we helped last year is coming back this year.”

“TaxPlanIQ lets us show clients the difference between where they are now and where they could be. The ROI reports make it incredibly clear—and that clarity makes it easy for clients to say yes,” Merrill said.

The Impact: Better Clients, Stronger Firm

Since incorporating TaxPlanIQ, Merrill’s firm has experienced a tangible transformation.

$$$

By offering paid tax planning engagements, the firm generated an additional 6 figures in revenue—just in the last months of the previous year alone.

100%

“We haven't had anyone say no. I think our close rate is 100%,” Merrill noted. “Once they see the ROI report, it’s a no-brainer.”

ROI

With customized reports and ROI visuals, Merrill’s team can confidently charge anywhere from $5,000 to $50,000 for tax planning, depending on projected savings.

One standout example?

Merrill’s firm saved a single client $1.6 million in taxes. That client has since referred others and is already lined up to work with the firm again.

TaxPlanIQ hasn’t just improved Merrill’s service offering—it’s changed how the firm operates.

“We’ve also raised our minimums and narrowed who we take on,” he said. “Now we’re focused on clients who truly benefit from tax planning. We’re not doing low-fee prep work anymore.”

Team morale has also improved. “Our tax manager sees the difference—less frustration, more fulfillment. Everyone’s on board with doing fewer returns and making more money.”

Advice to Other CPAs: Shift Your Mindset

When asked what he’d tell peers still stuck giving away free advice, Merrill didn’t hesitate: “The value is there. You just have to communicate it. TaxPlanIQ helps you do that better than anything else I’ve seen.”

Even long-standing assumptions have changed. “I used to think you couldn’t help W-2 clients. I even made a video on my Youtube channel saying that. Now I know that’s wrong—there are strategies for W-2 earners, and TaxPlanIQ helps uncover them.”

Merrill also sees value in the broader TaxPlanIQ ecosystem: “Even if you’re only using part of the platform, you can get real results. The community, the training—it all supports success.”

Conclusion: Scale Tax Planning in Minutes

Merrill’s story is a clear example of how a CPA firm can use tax planning software to transition from low-margin compliance work giving away free advice to offering high-value advisory services and charging premium fees. TaxPlanIQ makes it easy to upload a 1040, view curated strategies, and generate a custom, branded plan that clearly demonstrates client ROI—all in just minutes.

Ready to see what it can do for your firm?

If you’re ready to turn tax planning into a scalable revenue stream, sign up for a complimentary demo of TaxPlanIQ today.

Book a Demo.png?width=357&height=85&name=tpiq-logo%20(375x85).png)